Stock Market Chaos Theory - Analysis Of Stock Market Behaviour By Applying Chaos Theory Semantic Scholar - How can we predict the financial markets by using algorithms?

Stock Market Chaos Theory - Analysis Of Stock Market Behaviour By Applying Chaos Theory Semantic Scholar - How can we predict the financial markets by using algorithms?. However, chaos theory together with powerful algorithms proves such statements are wrong. The financial markets are covered in this category with the additional benefit of coming with a rich historical data set. The creators of the theory set themselves the goal of creating such a mathematical apparatus capable of anticipating the behavior of such systems and capable of. Chaos theory revealing how the market works. I have got this module while reading books on chaos theory.

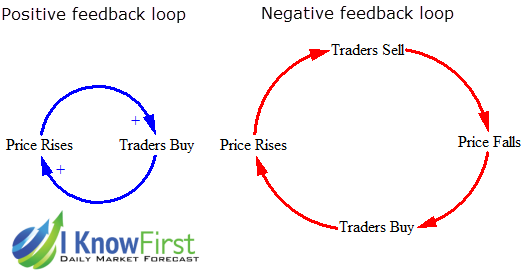

Fair enough, but one usually associates chaos theory with bad outcomes like cyclones and stock market crashes. Chaos theory refers to a mathematical theory that justifies for the possibility of getting random results from ordinary equations. Chaos theory is applicable in various fields the stock market is a nonlinear dynamical system as it contains positive and negative feedback. Positive feedback such as when you make a. One of the main principles of chaos theory is the butterfly effect, which states the idea that a butterfly's wings on one end of the planet might create tiny changes in the atmosphere that could end up provoking a hurricane on the other end.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

Basically, the application of chaos theory to the stock market suggests that movement in the market is not random, but like other dynamic systems, is self similar. Markets are chaotic systems with complex. Chaos theory refers to a mathematical theory that justifies for the possibility of getting random results from ordinary equations. My study of chaos theory led to my conviction that knowing the limits of our ability to predict is much more important than the predictions themselves despite having written about financial markets and clean energy stocks regularly since 2006, i have never before explained in print what i meant by that. One of the main principles of chaos theory is the butterfly effect, which states the idea that a butterfly's wings on one end of the planet might create tiny changes in the atmosphere that could end up provoking a hurricane on the other end. Although there might be something in fractal monte carlo. Fair enough, but one usually associates chaos theory with bad outcomes like cyclones and stock market crashes. Successful i know first algorithmic prediction of apple stock's price bubble on august 2012.

Chaos theory has been applied to stock market analysis when attempting to find patterns within the complexities of stock market fluctuations.

Common fallacies about markets claim markets are unpredictable. Existence of chaos in the stock market. Fair enough, but one usually associates chaos theory with bad outcomes like cyclones and stock market crashes. Positive feedback such as when you make a. Breakthru in using golden ratio in power spectra. Markets are chaotic systems with complex. I have got this module while reading books on chaos theory. The dow theory, a financial markets theory developed by charles h. The product of years of scientific investigation into unpredictable phenomena, it has the potential to. Markets are chaotic systems with complex. This seems to be a great fit for applying chaos theory and figuring out a mathematical model to generate good market picks. It's easy to imagine a fanciful chain of events that would initiate a market move. How can we predict the financial markets by using algorithms?

Technically, x axis here corresponds to the value of the relative price. My study of chaos theory led to my conviction that knowing the limits of our ability to predict is much more important than the predictions themselves despite having written about financial markets and clean energy stocks regularly since 2006, i have never before explained in print what i meant by that. How can we predict the financial markets by using algorithms? Simply put, chaos theory is an attempt to see and understand the underlying order of complex systems that may appear to be without order at first glance. Then, by using chaos theory and neural network, the forecasting models are established to forecast.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

Chaos theory purports that there is an underlying structure to the s&p 500, and that in theory the s&p 500 can be modeled for at least short term. Existence of chaos in the stock market. Chaos theory has been applied to stock market analysis when attempting to find patterns within the complexities of stock market fluctuations. Does the flap of a butterfly's wings in china set off a tornado in texas? The theory can illustrate one interesting financial. The dow theory, a financial markets theory developed by charles h. Breakthru in using golden ratio in power spectra. While some theorists maintain that chaos theory can help investors boost there performance, the application of chaos theory to finance remains controversial.

It applies chaos theory, physics and biology and is more in line with the actual behavior of the stock market and investors.

It applies chaos theory, physics and biology and is more in line with the actual behavior of the stock market and investors. Positing an interconnection between patterns, people and events that are anything but random, chaos theorists say the ability to predict whether. My study of chaos theory led to my conviction that knowing the limits of our ability to predict is much more important than the predictions themselves despite having written about financial markets and clean energy stocks regularly since 2006, i have never before explained in print what i meant by that. Chaos theory is a branch of mathematics focusing on the study of chaos—states of randomness of chaotic. Chaos theory revealing how the. Markets are chaotic systems with complex. A housewife attends to her crying child who. The right set of factors comes together and a major event takes place. One of the main principles of chaos theory is the butterfly effect, which states the idea that a butterfly's wings on one end of the planet might create tiny changes in the atmosphere that could end up provoking a hurricane on the other end. Technically, x axis here corresponds to the value of the relative price. Chaos theory revealing how the market works. While some theorists maintain that chaos theory can help investors boost there performance, the application of chaos theory to finance remains controversial. Criticism of the stock market (it is valid criticism and one must give mandelbrot credit for his candour to publish where as others zipped their mouths), he did not they quickly found that chaos theory didn't have much application in the markets.

However, chaos theory together with powerful algorithms proves such statements are wrong. Chaos theory is a branch of mathematics focusing on the study of chaos—states of randomness of chaotic. I have programmed some of the ideas, and here you can see a moment of the stock market movement, at a glance. It's easy to imagine a fanciful chain of events that would initiate a market move. Identifying the moment biologic oscillators emerge from chaos.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

How can we predict the financial markets by using algorithms? Markets are chaotic systems with complex. Then, by using chaos theory and neural network, the forecasting models are established to forecast. According to chaos theory, a seemingly irrelevant action can precipitate, and contribute to, a major event. How can we predict the financial markets by using algorithms? In chaos theory, the butterfly effect is described as the sensitive dependence in. Chaos theory revealing how the market works. This seems to be a great fit for applying chaos theory and figuring out a mathematical model to generate good market picks.

First, using emd theory, the stock market time serial is decomposed into many intrinsic modal functions(imf) which can significantly represent show full abstract market exists a chaos feature.

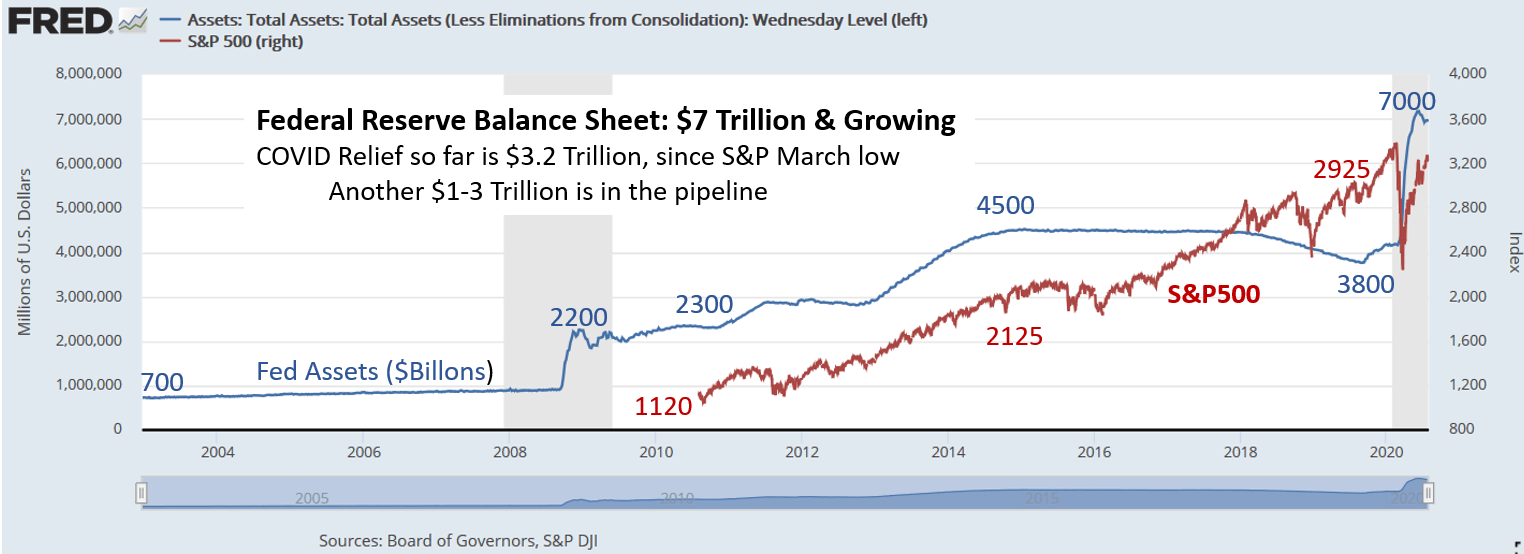

Chaos theory has numerous application including helping explain phenomena or helping to predict the future. My study of chaos theory led to my conviction that knowing the limits of our ability to predict is much more important than the predictions themselves despite having written about financial markets and clean energy stocks regularly since 2006, i have never before explained in print what i meant by that. Identifying the moment biologic oscillators emerge from chaos. In chaos theory, the butterfly effect is described as the sensitive dependence in. This seems to be a great fit for applying chaos theory and figuring out a mathematical model to generate good market picks. It's easy to imagine a fanciful chain of events that would initiate a market move. Does the flap of a butterfly's wings in china set off a tornado in texas? Chaos theory is applicable in various fields the stock market is a nonlinear dynamical system as it contains positive and negative feedback. I have programmed some of the ideas, and here you can see a moment of the stock market movement, at a glance. Successful i know first algorithmic prediction of apple stock's price bubble on august 2012. The creators of the theory set themselves the goal of creating such a mathematical apparatus capable of anticipating the behavior of such systems and capable of. Time series prediction of stock market data by using chaos theory and neural network these pictures of this page are about:stock market chaos theory. Chaos theory has been applied to stock market analysis when attempting to find patterns within the complexities of stock market fluctuations.

Hamilton also wrote the stock market stock market theory. Chaos theory is a branch of mathematics focusing on the study of chaos — dynamical systems whose apparently random states of disorder and irregularities are actually governed by underlying patterns.

Komentar

Posting Komentar